Save Up to £2,125 on EV Tax Before April 2025 – Here’s How!

Hello, EV owners! If you’re driving an electric vehicle, you could be facing a new Vehicle Excise Duty (VED) tax starting from April 1st, 2025. But don’t worry—we’ve got a smart workaround that could save you up to £2,125 depending on your vehicle type and registration timing!

I’m Andy Martin, Senior Product Design Engineer at EV Charge Kit, and today I’m going to show you how you can legally delay your road tax increase until April 2026—a simple trick that could put extra cash back in your pocket!

🎥 Prefer to Watch Rather Than Read?

Get all the details in our latest video! Click below to watch the full explanation on how to save up to £195 on EV tax before April 2025. 🚗⚡

▶️ Watch NowWhat’s Changing? The New EV Tax Rules Explained

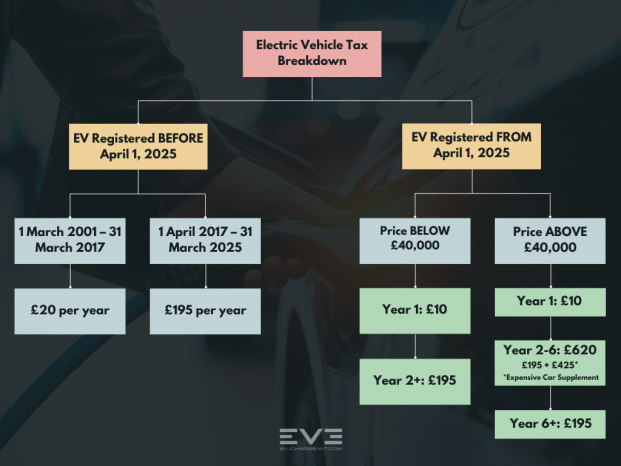

As part of the Autumn Budget, the government has introduced a new road tax for EVs, which takes effect on April 1st, 2025. Here’s how it affects you:

If Registered BEFORE April 1, 2025:

✅ EVs (1 March 2001 – 31 March 2017): Road tax will be £20 per year

✅ EVs (1 April 2017 – 31 March 2025): Road tax will jump to £195 per year

If Registering FROM April 1, 2025:

✅ EVs under £40,000 list price:

- Year 1: £10

- Year 2 onwards: £195 per year

✅ Luxury EVs (£40,000+ list price):

- Year 1: £10

- Years 2-6: £195 + £425 Expensive Car Supplement (Total: £620 per year)

- Year 7 onwards: £195 per year

Why This Matters:

🚨 Buying an EV over £40,000 after April 1, 2025, will cost you £2,125 in extra taxes over five years! (£425 x 5 years)

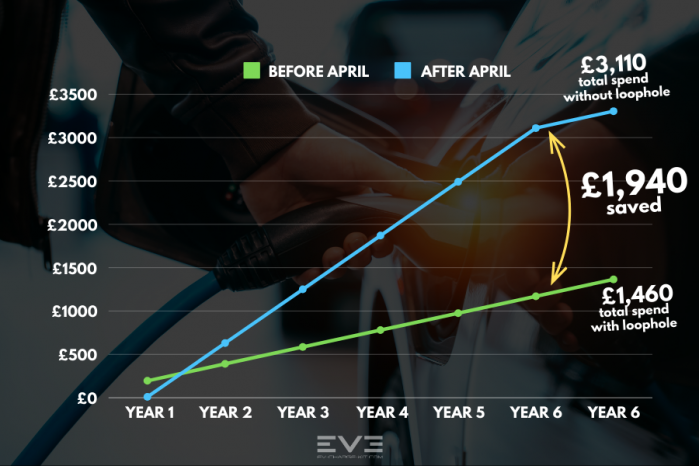

The Simple Loophole to Save Money

How to Avoid Paying EV Road Tax Until 2026

Before the April 1st deadline, follow these steps:

1️⃣ Re-tax your vehicle before April 1st, 2025

- Even if your car is already taxed, you can re-tax it early.

- If it shows as £0 tax, it will stay at £0 for another 12 months!

2️⃣ What if the government closes the loophole?

- If the rules change before April, there’s still an alternative:

- Declare your vehicle “Off Road” (SORN) before April 1st, 2025, for at least 2 days, then re-tax it.

- This resets the tax period, meaning you won’t pay tax until April 2026!

By taking action now, you lock in another tax-free year before the new rates hit.

Registering a New EV Before April 2025

If you’re planning to buy a new EV, register it before April 1st, 2025, to secure an even better deal.

🚙 EVs under £40,000

- Year 1: Road tax is just £10

- Year 2 Onwards: Standard road tax £195 per year

🚗EVs over £40,000 (Luxury Tax Applies)

- Year 1: Road tax £10

- Year 2 – Year 6: £195 + £425 Expensive Car supplement = £620 per year

- Year 7 onwards: £195 per year

- Total tax over 5 years: £2,125 😬

🎥 Want to find out more about how to save £2,125?

Find out more in our latest video! Click below for a full breakdown on how to save up to £2,125 on the Expensive Car Supplement 🚗⚡

▶️ Watch NowBy purchasing before April, you avoid an extra year of road tax—a huge potential saving over time!

What’s Next? Future Innovations from EV Charge Kit

At EV Charge Kit, we are inventors, not imitators! 🚀 Our upcoming products will help EV drivers save money, charge smarter, and drive more efficiently.

✅ New charging solutions ⚡

✅ Innovative charging cables & accessories 🔋

✅ Exclusive money-saving tips for EV owners 💡

Click here to sign up to our newsletter and be the first to know about all new tips, tricks and products you need!

Final Thoughts: Act Now & Save!

Don’t wait until it’s too late! ⏳

- Re-tax your EV before April 1st, 2025

- If you’re buying a new EV, register it before the deadline

These simple steps could save current EV owners up to £195 for the first 12 months—or £2,125 over five years for luxury EVs!

🚀 Share this with other EV drivers so they don’t miss out! 💰

FAQs: EV Tax & Savings Explained

Can I really avoid the EV tax increase?

What if I forget to re-tax my vehicle before April?

Does this work for all electric cars?

What if the government changes the rule before April?

Are EVs still a good investment despite the new tax?

🔋 Stay charged & stay ahead! 🚗⚡ Follow EV Charge Kit for more EV savings tips! 💰💡